To follow is information I’ve compiled on the ballot questions and propositions Star Valley Ranch voters will have to decide on for the November 5th General Election.

Constitutional Amendment A

What is Constitutional Amendment A asking? Here’s the question:

The adoption of this amendment would separate residential real property

into its own class of property for purposes of property tax assessments.

The amendment would authorize the legislature to create a subclass of

owner occupied primary residences. ____ For ____AgainstI asked our House District 22 Representative, Andrew Byron, for his thoughts on the question of adopting Constitutional Amendment A. Here is his response:

“Without Amendment A to the Wyoming Constitution, the legislature cannot provide property tax relief for primary residential properties. Here is the summary from the SOS [Secretary of State].

https://sos.wyo.gov/Elections/Docs/2024/2024_BallotIssues.pdf

It’s very simple! A yes vote allows future legislators to potentially reduce your primary residential property taxes while still following the Wyoming Constitution.

A no vote takes away an option for future legislators to reduce your primary residential property taxes.”

You can also listen to the following audio file from our Senate District 16 Senator Dan Dockstader about Constitutional Amendment A. He participated in this Weekday Wakeup interview on October 15th conducted by Star Valley Independent (SVI) radio.

Finally, read more details on Constitutional Amendment A in this informative article from the SVI via the Wyoming News Exchange.

Star Valley Ranch Lodging Tax Option

Also on our ballot next month is a proposal to voters to consider a Lodging Tax Option at Star Valley Ranch. Here’s the question:

Shall the Star Valley Ranch Town Council, the Governing body for the Town

of Star Valley Ranch, be authorized to enact a two percent (2%) lodging tax

imposed on hotels, motels, campgrounds, dude ranches, bed and breakfasts,

and similar establishments providing quarters or space for transient guests

for the primary purpose of promoting travel and tourism in the Town of Star

Valley Ranch? This tax will be imposed for four (4) years.

____ For the Town Lodging Tax ____ Against the Town Lodging TaxWhile the question language is a bit clunky, what I can tell you is the only lodging we currently have at Star Valley Ranch (SVR) is in the form of short-term-rental (STR) properties (i.e., AirBnB, VRBO, etc.). Perhaps in future there will be other forms of lodging at SVR—but for now, it’s just STRs.

Another thing to think about when considering this ballot question is that a lodging tax would be “a tax you do not pay” as it would be born by the patrons/renters of those STR properties.

If approved, the Town of SVR Travel & Tourism Board would administer the lodging tax funds part of which would be put to use for visitor education and to sponsor town events (such as the Ranch Rendezvous Market held this past summer).

Specific Purpose Tax—aka the “6th Penny”

This ballot proposition is a little more complex. It’s also a lot longer to read, so I’m not going to reprint all of it here. Here’s a synopsis of the question:

Shall Lincoln County, Wyoming, be authorized to adopt and cause to be

imposed a one percent (1%) specific purpose sales and use excise tax with

the County… For the following Projects in the amount of $23,354,078 and

interest earned thereon: [Note there are nine projects listed from the nine

participating municipalities. SVR is number eight.] 8. $3,300,000 to the Town

of Star Valley Ranch for Walking Paths that lead to forest trails, development

of Town commons, and pavement of major arterial roads within the Town

of Star Valley Ranch.

____ For the Tax ____Against the TaxI’m sure many of you may have seen anti-6% tax signage posted around the county as well as anti-6% tax information being promulgated on social media. Some (not all) of the latter information is misleading or incorrect. Just to clarify, here a few facts about the 6th Penny Specific Purpose Tax.

State law allows counties, in cooperation with cities and towns, to fund specific projects through a voluntary sales tax.

Counties, cities, and towns pass resolutions that include proposed projects and amounts needed to complete those projects. Voters are then asked to vote on those projects.

If approved by the majority of voters, a “sixth penny” sales tax is added to purchases. When the specific amount is collected, the tax stops.

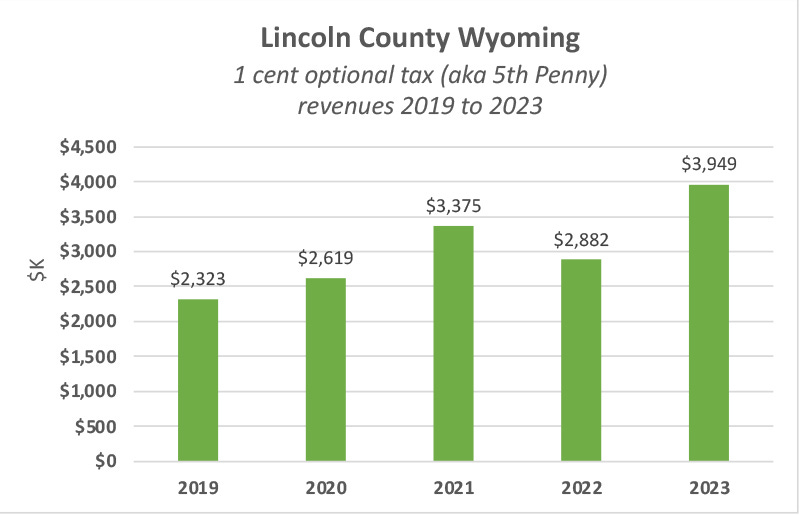

I took a look at Lincoln County’s 5th Penny optional sales tax revenues as a basis to try and determine how long an approved 6th Penny tax would be around. From the chart below the average annual revenue is about $3M and the average annual revenue increase is about 10%. Thus, I’d estimate an approved 6th Penny tax would be around for 6 to 7 years.

The Town of SVR recently posted information about the 6th Penny on their town website; you can check that out here.

Finally, you can also read this helpful article about the 6th Penny published by SVI.

I hope some of the above information is helpful to voters when it comes to making an informed ballot decision. Please email me if you have questions and I’ll do my best to assist!

Was this post useful? If so, please share with your friends and neighbors! Thanks!

Want to customize your Close to Home 307 subscription and the number of emails you receive each week? Please click this About page link and scroll midway down the page to learn how to update your settings.